south dakota property tax rate

Please call the Treasurers Office at 605 367-4211. Depending on where the property is located the homeowner has approximately three 3 or four 4 years from the date the tax lien certificate was.

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Sales Tax Tax Rules Tax Preparation

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128.

. Then the property is equalized to 85 for property tax purposes. The taxing authorities then apply an 85 equalization ratio to get the propertys taxable value. Across the state the average effective property tax rate is 122.

Local real property taxes in South Dakota vary from one to three percent of the market value of the structure with most rates falling around two percent. South Dakota has recent rate changes Thu Jul 01 2021. Homeowners living in a primary residence in South Dakota are eligible for a tax rate reduction.

The winning bidder is the one willing to pay the most for the tax lien. However five-year property tax abatements are available on new structures or additions to existing ones. As of 2005 South Dakota has the lowest per capita total state tax rate in the United States.

Overview of south dakota taxes. Click the tabs below to explore. The number came from the.

Below we have highlighted a number of tax rates ranks and measures detailing South Dakotas income tax business tax sales tax and property tax systems. See Results in Minutes. 31 rows The state sales tax rate in South Dakota is 4500.

Across the state the average effective property tax rate is 122. South Dakota is one of seven states that do not collect a personal income tax. Select the South Dakota city from the.

12 hours agoThe Minnehaha County Equalization Office which determines the taxable value of all property announced it recorded an 18 market increase compared to last years sales. Learn About Owners Year Built More. On the plus side several programs help senior citizens with high property tax bills.

Across South Dakota the average effective property tax rate is 122. If your taxes are delinquent you will not be able to pay online. Municipalities may impose a general municipal sales tax rate of up to 2.

Usually that system worked out in favor of farmers and ranchers who despite. The state of South Dakota has a relatively simple property tax system. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

Sales Tax Rates by Address. For instance if your home has a full and true value of 250000 the taxable value will add up to 250000 multiplied by 085 212500. You can look up your recent appraisal by filling out the form below.

In South Dakota tax collectors sell tax lien certificates to the winning bidders at the delinquent property tax sales. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. The median property tax in tripp county south dakota is 900 per year for a home worth the median value of 69400.

Dictated by South Dakota law this operation is supposed to allocate the tax burden in an even way statewide with equitable property tax rates. This surpasses both the national average of 107 and the average in North Dakota which is 099. Calculate how much youll pay in property taxes on your home given your location and assessed home value.

By reason of this en masse approach its not only probable but also certain that some market worth evaluations are inaccurate. This is the value upon which your South Dakota property taxes are based. Convenience fees 235 and will appear on your credit card statement as a separate charge.

Searching for a sales tax rates based on zip codes alone will not work. South Dakota Property Tax Rate. Detailed south dakota state income tax rates and brackets are available on this page.

However revenue lost to South Dakota by not having a personal income tax may be made up through other state-level taxes such as the South Dakota. 102000 x 101000 1020 This same computation is performed for each taxing jurisdiction that can tax the property with the sum of all taxes for each taxing jurisdiction being the total property taxes due on the property. With local taxes the total sales tax rate is between 4500 and 7500.

How does South Dakota rank. Ad Look Up Any Address in South Dakota for a Records Report. Historically ag land property tax rates in South Dakota were determined using data on recent comparable land sales.

Find Details on South Dakota Properties Fast. South Dakota has no state income tax. Tax rates set by local government bodies such as municipalities and school districts are applied to the full market value of residential property.

As Percentage Of Income. The state allows people above seventy years earning an income below a particular level not to pay property taxes until they sell their home. Compare your rate to the South Dakota and US.

Only the Federal Income Tax applies. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. Click Search for Tax Rate Note.

The first step towards understanding South Dakotas tax code is knowing the basics. Municipal tax levy is 10 per thousand. If you have a home in South Dakota you can pay less than 15 percent of your property value in yearly taxes.

A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. Property tax on this property for city purposes would be. The state does not levy personal or corporate income taxes 135 inheritance taxes 136 or taxes on intangible personal property.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Tax

Property Taxes How Much Are They In Different States Across The Us

Property Tax South Dakota Department Of Revenue

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Perce State Tax Infographic Finance Function

9 States Without An Income Tax Income Tax Income Sales Tax

Property Tax South Dakota Department Of Revenue

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Local Marketing Legal Marketing Business Tax

Property Taxes Calculating State Differences How To Pay

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Thinking About Moving These States Have The Lowest Property Taxes

Property Tax Comparison By State For Cross State Businesses

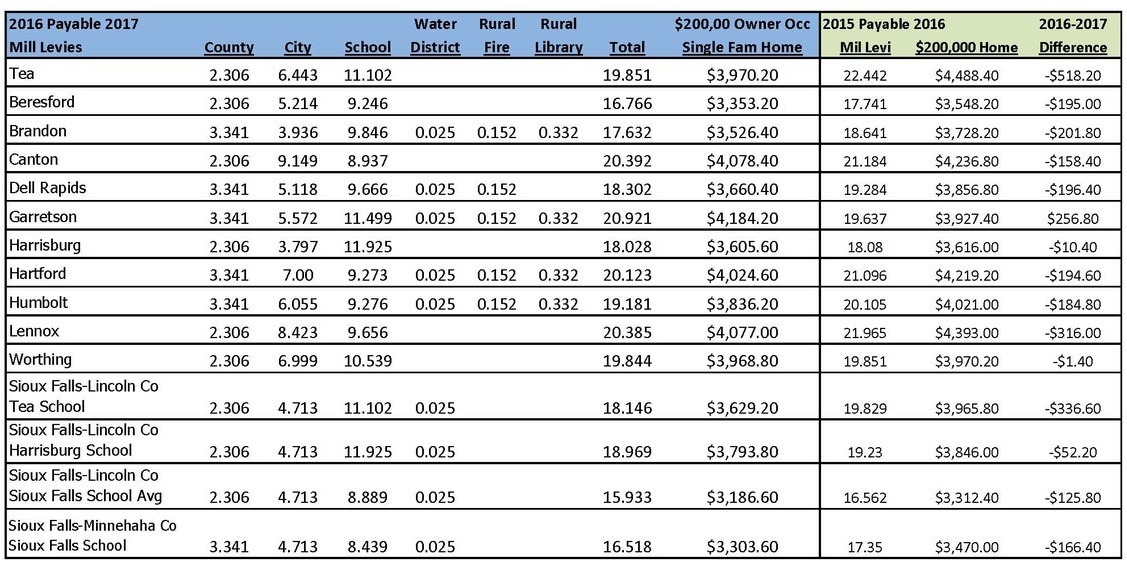

Tax Information In Tea South Dakota City Of Tea

Property Tax South Dakota Department Of Revenue

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Income Best Places To Retire State Tax